Can you believe it’s December already? So much has happened since March, and businesses have had to adapt their approach to very different — and difficult — circumstances. While some have done this fairly successfully, others are still working through it. We’ve taken a look at HubSpot’s benchmark data to see the state of sales and marketing in EMEA compared the start of COVID-19. Here’s what it said at the end of November.

Sales

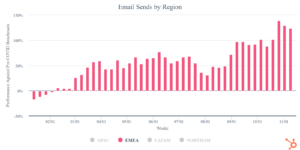

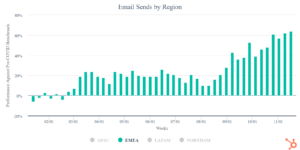

- Sales email sends are up 124% from the pre-covid benchmark

- Sales email responses are down -26% from pre-covid benchmark

1-1 sales email activity has increased, but response rates have decreased. As sales teams try to engage their audiences, it seems consumers are being overwhelmed with emails and only really engaging with sales teams on their own terms.

What does this tell us? Well, while email is still an incredibly valuable channel for salespeople, you won’t get far blindly panic-emailing any old prospects to increase responses.

People are more in control of their own sales journey than ever. Not only can we now use quality data to help us decide the best people to email, but buyers have a lot more options these days to signal their interest – like visiting pages on your site, converting on an offer, and signing up for a demo, etc.

If you want people to respond to you, you can make sure you’re being more deliberate and targeted with who you’re emailing, writing genuinely helpful, highly-relevant copy for your emails, and using a CRM like HubSpot to reach out to people who have already signalled their interest in your business.

- Sales calls are up by 33% from pre-covid benchmark.

Even though sales email engagement is down, a great takeaway for sales teams is that calls are now trending 33% above the benchmark. This is a massive turnaround for call prospecting, as it dropped to around 25% below the benchmark from March to June, only picking up later in the Summer.

On top of this, we can see that smaller companies were the first size to return to the phone. When the pandemic created a time of uncertainty, trustworthy relationships are what businesses could lean on to get through hardships.

Smaller companies rely so heavily on these close-knit relationships as well as traditional prospecting channels like phones, so it’s not all that surprising that smaller companies were the first to start picking up the phone again.

- Conversions in EMEA are up by 106%

More good news is conversions are way, way up! In fact, they’re 106% above the pre-covid benchmark. People are converting into leads and purchasing more, which may be something to do with Christmas being just around the corner or those planning ahead for the new year.

It also could be something to do with more opportunities to convert online. Now, customers are able to take their sales process in their own hands with convenient avenues like online chat.

- Live chat is trending over 90% above the pre-COVID benchmark

Buyer research has shifted to a more on-demand, in-the-moment experience, and live chat facilitates this. Chat volume has gradually increased over the past six months — trending over 90% above the benchmark since September.

Since businesses have moved online, consumers have started using live chat as a resource for real-time help. Lots of people are now working from home and communicating on their preferred time and channel, they’re expecting responses to their queries faster and on their own schedule. Now, consumers pretty much expect a live chat option when interacting with brands. That’s why you’ve probably seen more of them about on websites!

Sales teams are now using live chat to nurture leads, and customer service personnel are using it to support customers. It’s proving to be one of the most effective channels for communicating with customers because it allows people to interact with a company on demand in the most convenient way for them.

Deals

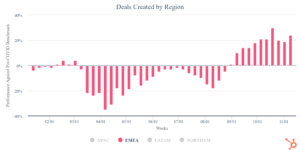

- Deals created in EMEA are 32% higher than pre-covid benchmark

Over the last few months, we’ve seen businesses adapt to new circumstances extremely quickly. There was a lot of fluctuation in sales outcomes due to the changing buyer circumstances and economic uncertainty brought by the pandemic. Now, businesses are perhaps more used to operating under these circumstances, and while it’s certainly a difficult time, the data suggests that EMEA companies are starting to move forward.

In April, we hit the lowest point for total deals won at 36% below the benchmark. Following that, we saw steady recovery from late-April to mid-June where deals-won returned to the same levels they were at before the start of the pandemic. Deal performance continued to improve through July and August, and at the end of November, deals were hitting 32% higher than the pre-COVID benchmark.

- Deals closed in EMEA are 5% higher than pre-covid benchmark

In April, we not only saw the lowest number of deals won recorded, but the lowest number of deals created too. At the start of April, deals created fell to 30% below the benchmark and remained below pre-COVID levels until mid-June. Over the summer, it continuously improved.

However, EMEA had a recent return to pre-COVID benchmarks as it was trailing behind all the other regions up until July and August. It was 18% below the benchmark, while all other regions sat at least 10% above it. In September, EMEA won deals surpassed the benchmark for the first time since March and is now 5% above pre-COVID levels.

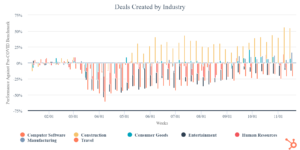

Construction, Manufacturing, and Computer Software have all been trending above the benchmark since the start of September. Construction is the top-performing industry, trending roughly 40% above pre-COVID levels, probably because these industries haven’t been as structurally impacted as others.

Industries like Travel, Entertainment, and Human Resources are still working towards getting back to those pre-COVID levels. Though they’re not at the benchmark yet, deal creation for these industries is looking better than it was at the start of the pandemic.

Marketing

- Email sends are up 64%

- Open rates are up by 24%

With buyer interest so strong, marketers have reinvested in email. Marketing email volume has increased since the start of the pandemic and is currently a year-high 62% above pre-COVID levels in EMEA.

Response rates are also performing well, remaining at 10-20% above the benchmark since April. It’s brilliant to see marketing emails steadily improving during this time, and it’s a prime example of the effects of a well-written, thoughtful, and highly relevant email campaign.

- Website traffic in EMEA is up 58%

Website traffic in EMEA is at a year-high currently at 58%. As buyers continue to do their shopping online, businesses with the most established online presence seem to be seeing the most benefit.

If we’re looking at the industry specifics, Computer Software remains the highest performing in regards to web traffic at 61% above the benchmark. This reflects the digital transformation that was already on its way before the pandemic but has now sped up as more were forced to move online.

Compared to where we were in March, nearly all industries have returned to around their pre-COVID levels. For example, even a structurally impacted industry like Entertainment was 18% below the benchmark in July, but has been above or sitting just below the benchmark for the past few weeks.

What does HubSpot’s data tell us?

- Businesses have adapted, and EMEA sales outcomes look so much better compared to where we were in March.

- However, for many businesses — especially those in structurally-impacted industries — we’re nowhere near where we were prior to the pandemic.

- Most businesses understand they need to adapt their strategies in some way if they want to continue to operate in a post-COVID world.

- We know that businesses and consumers were already moving online before the pandemic, but COVID-19 has accelerated their digital transformation at a much more rapid pace.

- Email is still an incredibly valuable channel, but you won’t get far blindly emailing any old prospects to increase responses.

- People are getting back to sales calling to build trust and nurture relationships in this post-in-person-meeting world.

- What were once novelty features and services — like live chat — are now vital tools for prospecting as well as customer service.

- Now that many have moved online and are discovering all the benefits that come with it, businesses will continue to invest in digital channels to reach their target audience.